Are you planning to retire on a government pension?

Well you may be in for a rude shock. As you will read from the – Stop, Ready, Go Guide, you will find insight into just how hard living on a government pension may be and how it may impact your quality of life. Coral gives you all the tips to consider how to maximise your retirement through a planned and structured approach.

MAKE A PLAN

Are you planning to retire on a government pension?

If so, consider carefully your fortnightly income.

The below table shows the fortnightly rate of an age pension in Australia from March 2014. The pension is reviewed every March and September.

| Pension rates per fortnight | Single | Couple each | Couple combined | Couple each separated due to ill health |

|---|---|---|---|---|

| Maximum basic rate | $782.20 | $589.60 | $1,179.20 | $782.20 |

| Maximum pension supplement | $63.90 | $48.20 | $96.40 | $63.90 |

| Energy supplement | $14.10 | $10.60 | $21.20 | $14.10 |

| TOTAL | $860.20 | 648.40 | $1,296.80 | $860.20 |

This amounts to a minimum of just $294.80 per week (a couple each). In taking into account these figures, bear in mind that not only is the cost of living increasing but so too is life expectancy.

The Australian male full time adult average weekly ordinary time earnings is $1,593.60.

As a male, to keep your lifestyle on par with the way you live now, into retirement (where your lifestyle shifts to 30-40 hours per week without work). My calculations have concluded you would need capital of $2.77 million if invested in a term deposit fund with an average 3% interest rate p/a.*

The Australian female full time adult average weekly ordinary time earnings is $1,308.80.

As a female, to keep your lifestyle on par with the way you live now, into retirement (where your lifestyle shifts to 30-40 hours per week without work). My calculations have concluded you would need capital of $2.27 million if invested in a term deposit fund with an average 3% interest rate p.a.

*Source Australian Bureau of Statistics (Average weekly earnings, Australia trend (a) May 2015)

Will you be able to live the lifestyle you are accustomed to on the pension budget with 30-40 hours a week of extra free time? How does this compare to living on the pension budget in retirement.

It’s important to consider if your savings plan is on track.

- Will you be able to live in the manner you are used to, upon retirement?

- Do you want to be financially secure when it’s time for you to retire?

- Are you prepared to put your retirement nest egg into a ‘sit, hope and pray’ fund?

Upon consideration of these questions, I decided I wanted to take back control of my finances and, in 1997, after putting some time and energy into researching Self-Managed Super Funds, decided this was the why I wanted to invest.

Here are some of the lessons I learnt;

- The general view was that it was difficult to invest and manage a Self-Managed Super Fund

- Managed superannuation funds are very restricted in their investments

- I had no control over my own money. I was leaving the most important wealth creation strategy to a stranger that knew little of our personal retirement goals

- Managed super funds are a one-size-fits-all strategy

- In a managed superannuation fund we did not have an option of selling our shares at the top of the market

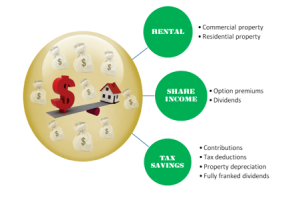

- We could not earn extra option premiums on our blue chip shares

- We realized we were still paying ongoing fees and charges in our managed superannuation fund – even when the share market had a downturn

And here are some of the questions raised after I began researching a SMSF;

- Why had I not taken any serious interest in something that should’ve been performing to build wealth?

- Why were there so many costs involved in a managed superannuation fund?

- Why was their no urgency for education in a superannuation fund?

- Managed super funds had no exit strategy or stop loss. Therefore, what insurance was in place for another GFC?

- Why did we not have any insurance on our investments?

- Why were there no tax deductions on any investments in our managed/retail superannuation fund?

All of these questions led me to the conclusion that a SMSF was the wisest option for me.

We decided that our self-managed super fund should be a corporate trustee where we, as directors of the corporate trustee, were responsible for starting and running the company – all the while being sure to comply with the relevant rules and regulations of a SMSF. We set out what we wanted to achieve in the trust deed (Business Plan). This outlined our wealth strategies and goals. Our sole purpose with our SMSF was to invest wisely and make money for our retirement. We realised that with multiple passive income streams growing exponentially, it was possible to leave an ongoing family legacy. These were the aspects that excited me and inspired me to create wealth for my retirement and for my family.

Once I realised a SMSF was for us, we needed to get ourselves ready.

There were 7 important steps we needed to consider.

7 STEPS TO CONSIDER WHEN ESTABLISHING

A SELF-MANAGED SUPER FUND.

- Decide on a name for the fund

- Obtain a Trust Deed

- Decide on whether you’re going to appoint an individual or corporate trustee

- Prepare an Investment Strategy

- Complete ATO obligations such as:

- Elect to become a regulated fund

- Complete a Trustee Declaration

- Apply for Tax File Number, Australian Business Number and perhaps register for GST

- Complete Applications for Memberships

- Open a bank account

- Rollover Funds from current super fund or start making contributions

Once you have decided on the fund name your accountant can assist with steps 2-7.

IMPORTANT

Before deciding on a SMSF you should seek professional advice to determine whether it suits your financial situation and to ensure that there’s going to be a cost benefit derived by adopting this choice of investment. You also need to determine whether it’s more cost effective to opt for a SMSF or remain with your current fund.

If the main reason for wanting a SMSF is to allow for a broader range of investment options (rather than it being about saving fees and charges), you should still seek expert advice. This ensures that you approach the establishment of the SMSF in the appropriate order and are also clear on your obligations as a trustee.

Your accountant will be able to explain the difference between having a Corporate Trustee or Individual Trustees and assess which option best suits your financial circumstances. In most cases, it is advisable to appoint a Corporate Trustee. This means that a company will act as trustee of the fund. The members of the fund will be the directors of the trustee company.

There are a number of important processes to be executed and your accountant/adviser can assist with these necessary steps; order the Trust Deed, arrange for preparation of the investment strategy, establish and register your trustee declarations – these will explain your obligations as a trustee of a SMSF, assist with complying with SMSF status, establish your Australian Business Number and Tax File Number applications for memberships and in some cases, assist with opening a bank account.

Once you have the complying fund status certificate issued by ATO and a bank account opened, you can start contributing to your fund or alternatively, apply to your current fund for a rollover of funds.

Other important matters to consider

Insurance – Life Insurance and Total Permanent Disability (TPD).

You may have this insurance cover with your existing Managed Fund and will need to complete a full rollover of funds, ensuring that you have adequate insurance cover in place in your SMSF. Once these policies are in place with your SMSF, you can then cancel your cover and complete final rollover of funds from the old fund to the new.

If you do not have any existing insurance cover within your fund, you should seek advice on whether it’s best to add insurance to your SMSF or acquire separate insurance policies (outside of the fund).

Death of a Member

Each member should complete a ‘Beneficiary Details Form’. In the event of death, the executer will need to know who the member’s beneficiary is – i.e. who is entitled to the member’s balance of super. Careful consideration should be given to your choice of beneficiary for the continuity of the fund (i.e. if non-cash assets are held and the other member is not the beneficiary then there could be a forced sale to pay out to a non-member beneficiary).

Estate Planning

Ensure the members have a current Will in place. The Executor will need to have an understanding of their responsibilities under the Will.

Consider whether an Enduring Power of Attorney may be required for reasons such as failing health. A health care directive may be considered.

Trustee Obligations

It is crucial that a trustee understand their obligations. This is a highly regulated area and the duties and responsibilities of trustees are extensive and if you get it wrong can be very expensive.

*Source Fiona Jeffs – Quality Accounting

Whether you earn a six-figure salary or a minimum wage is not important.

Remember, it is the amount of money that ‘sticks’ that truly matters.

Important questions I had to ask myself 18 years ago in order to clarify my commitment to building wealth in a SMSF for my future;

Ask yourself:

My Income before Tax $__________________

My Income after Tax $ __________________

What action can I take to improve my wealth goals strategy? ________________________

How much can I contribute to superannuation? Weekly or yearly $____________________

How much of my money will I be able to keep if I do that? $___________________

How much extra could I save per week? Be familiar with your weekly budget.

$___________________________

How much can I save if I sacrifice just a few luxuries a week and instead invest in my wealth creation? $____________________________

What strategies am I interested in to create wealth for my future? __________________

Is there something I’m good at / talented in that could be optimized in order to earn extra cash to invest? _________________

Adjusting our spending habits and making a few sacrifices can make a REAL difference. Take action and spend some time visualizing the future you deserve. The earlier in life you start, the smaller the increments you need to make and the bigger the pot of gold you can create in the end – we could reduce our tax effectively. Investing in a SMSF is the easiest strategy I’ve experienced to make this possible. I started my SMSF at the age of 34 but I believe that starting sooner would have been even better and more financially beneficial. Our money and our fund could grow exponentially.

Personally, if we did not make the effort to contribute some of our before-tax income, it would have gone to income tax and therefore, we would not have that money to invest. Those finances are a bonus. Without the contribution to the SMSF, the money would’ve been taxed – it’s as simple as that our money grew. We only pay 15% on any income earned and 10% capital gains tax on property invested when we hold it for more than 12 months in a SMSF. Guess what? It will all be tax free at the end, in our retirement. Enjoy the gift of giving; the ATO rewards you for educating yourself in wealth creation.

For further information, go to the ATO’s very informative website – www.ato.gov.au You should also visit www.mrtaxman.com.au for tax minimization.

There is much speculation about what will happen with self-managed superannuation funds in regards to any changes in legislations, accounting and auditing fees. Keep in mind the tax you will be paying outside of that superannuation fund, burdening the next generation. When thinking of my own children, this does not sit at all well with me. Governments have to find their spending money from somewhere.

We could leverage to buy income-producing assets that have taxable deductions. This was not possible in our retail/ managed one-size-fits-all superannuation fund. I took control, and became financially independent and reduced my tax more in a Self-Managed Super Fund.

We are fortunate to live in a wonderful country and yes, we do have a higher tax rate than other countries around the globe but to a certain degree that is for the peace of mind and assurance of day-to-day life in a safe and civilized country with good infrastructure, roads, schools and hospitals among many other benefits. We do pay a lot of tax but, in making sure we paid ourselves through our SMSF, I believe we are helping to reduce some of that burden.

Our priority is to pay ourselves in our SMSF first so that we do not burden our children with the increased taxes that they will have to pay to meet the ageing population. With the elderly living longer and becoming more dependent on the government, the result will be a massive shortfall in pensions and huge demand on the health sector.

I ask the question again. Do you want to be dependent on Government Pension?

Do you want financial security when you retire?

If I had of continued in a retail managed fund, I would consider the following;

• How much money is in my retail/managed super fund?

• How many retail/managed funds do I have?

• What are the fees and charges?

• What are the investments inside my managed/superannuation fund actually achieving?

• What strategy is in place if the share market has a downturn?

Look into what your managed /retail super fund is doing for your wealth creation.

Also, do a search for any unclaimed superannuation. Here is the ATO website for finding lost superannuation funds https://superseeker.super.ato.gov.au